It has been a tumultuous year for the UK steel market, with challenges ranging from economic uncertainties to geopolitical tensions shaping the landscape. In the first half of 2023, the steel industry faced significant disruptions, and the second half brought ongoing volatility influenced by high production costs and geopolitical factors. Structural steel prices experienced a decline in the UK, albeit not uniformly, while steel plate prices remained elevated.

Q3 2023 Recap: Navigating Uncertainty in the UK Steel Market

The third quarter of 2023 witnessed persistent challenges and fluctuations in the UK steel market. Faced with economic uncertainties, high production costs, and geopolitical tensions, the UK steel industry experienced a mixed landscape. Structural steel prices exhibited a decline, though not uniform, while steel plate prices remained elevated. Global economic and geopolitical factors, including rising interest rates and inflation, exerted further pressure on the steel market.

As the quarter progressed, production cuts, import quotas, and supply chain disruptions due to ongoing conflicts across the world have also added complexities to the scenario.

Q4 2023 Dynamics: Steel Production Cuts and Supply Chain Challenges

As we enter the final quarter of 2023, EU Hot Rolled steelmakers are implementing production cuts. These cuts, combined with disruptions anticipated from trade negotiations at BlechExpo 2023, are expected to tighten supply and drive steel prices to increase. Some steel companies are already suspending or shutting down capacity, signalling a strategic move to balance supply and demand.

Importantly, import quotas for the fourth quarter were quickly exhausted, indicating a reliance on EU suppliers to meet market demands. This scenario is expected to continue into Q1 2024, intensifying steel purchases and supporting further price growth.

Influencing Factors: Energy Costs, Geopolitical Developments, and Sanctions

Several factors continue to impact steel prices in the UK. Energy costs, influenced by geopolitical tensions and conflicts, are on the rise. The recent EU sanctions against Russia have disrupted the steel supply chain, leading to increased restrictions on imports and a greater reliance on EU mills. Along with that, the Israel-Hamas conflict has also added to the already tense worldwide supply chains in the steel industry. If the conflict is prolonged, steel prices in the UK could see an adverse effect.

Global and EU Steel Market Overview

The global steel industry is grappling with uncertainty, with geopolitical factors and inflation contributing to fluctuations in international steel prices. In the EU, apparent steel consumption has faced a prolonged decline, exacerbated by ongoing conflicts around Europe and the Middle East and high inflation. While certain sectors, such as automotive and mechanical engineering, show resilience, the construction sector is experiencing a downturn.

Price Forecasts for Early 2024

Looking ahead to early 2024, mild and stainless steel prices are expected to increase. Although prices have been reasonably stable in Q4 2023, steel suppliers suggest a potential rise in prices with an estimated 15% increase in Q1 2024.

While some market analysts anticipate a 7% decline in steel prices in December 2023, the overall conclusion is that the signs point to an increase in price due to cost-driven factors, production cuts, seasonal restocking along with the impact of the wars in Ukraine and conflict between Israel and Hamas.

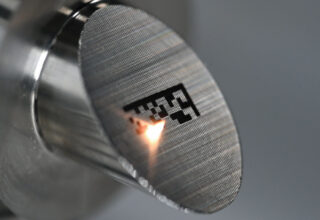

ADS Laser Cutting is the Premier Metal Laser Cutting, Folding, Fabrication, Finishing and Assembly in the UK. Providing Bespoke to Volume Solutions.